Roth Ira Investment Limits 2025. 2025 roth ira contribution limits. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Roth ira contribution limits (tax year 2025) brokerage products: In 2025, these limits are $7,000, or $8,000 if you’re 50 or.

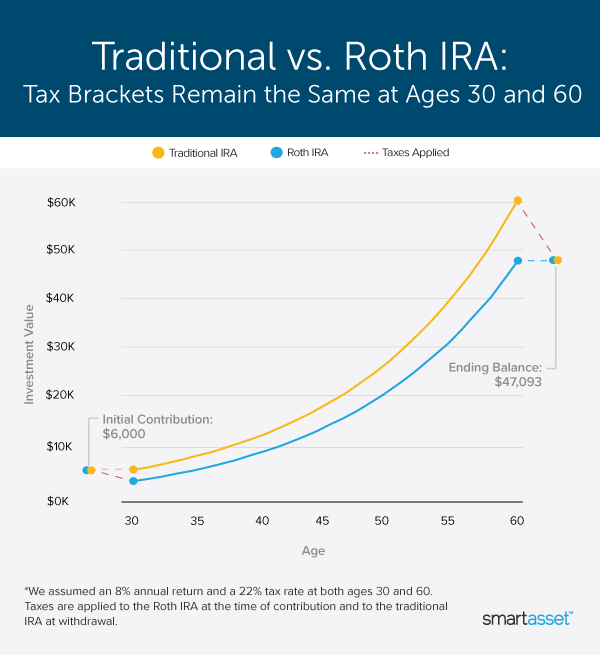

Roth Ira Limits 2025 Mfj Myra Yolanda, Here's an example of how your money can grow over time if you max out your roth ira in 2025 and continue to contribute $7,000 annually. The charles schwab corporation provides a full.

Roth Ira Limit In 2025 Tildi Gilberte, The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older. The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older.

Ira And Roth Ira Limits 2025 Minda Sybilla, However, keep in mind that your eligibility to contribute to a roth ira is. 2025 roth ira contribution limits.

2025 Roth Ira Limits 2025 Over 50 Marys Sheilah, Your personal roth ira contribution limit, or eligibility to. Use nerdwallet's free roth ira calculator to estimate your balance at retirement and calculate how much you are eligible to contribute to a roth ira.

Ira Contribution Limits 2025 Roth Traditional Moira Tersina, The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older. Your personal roth ira contribution limit, or eligibility to.

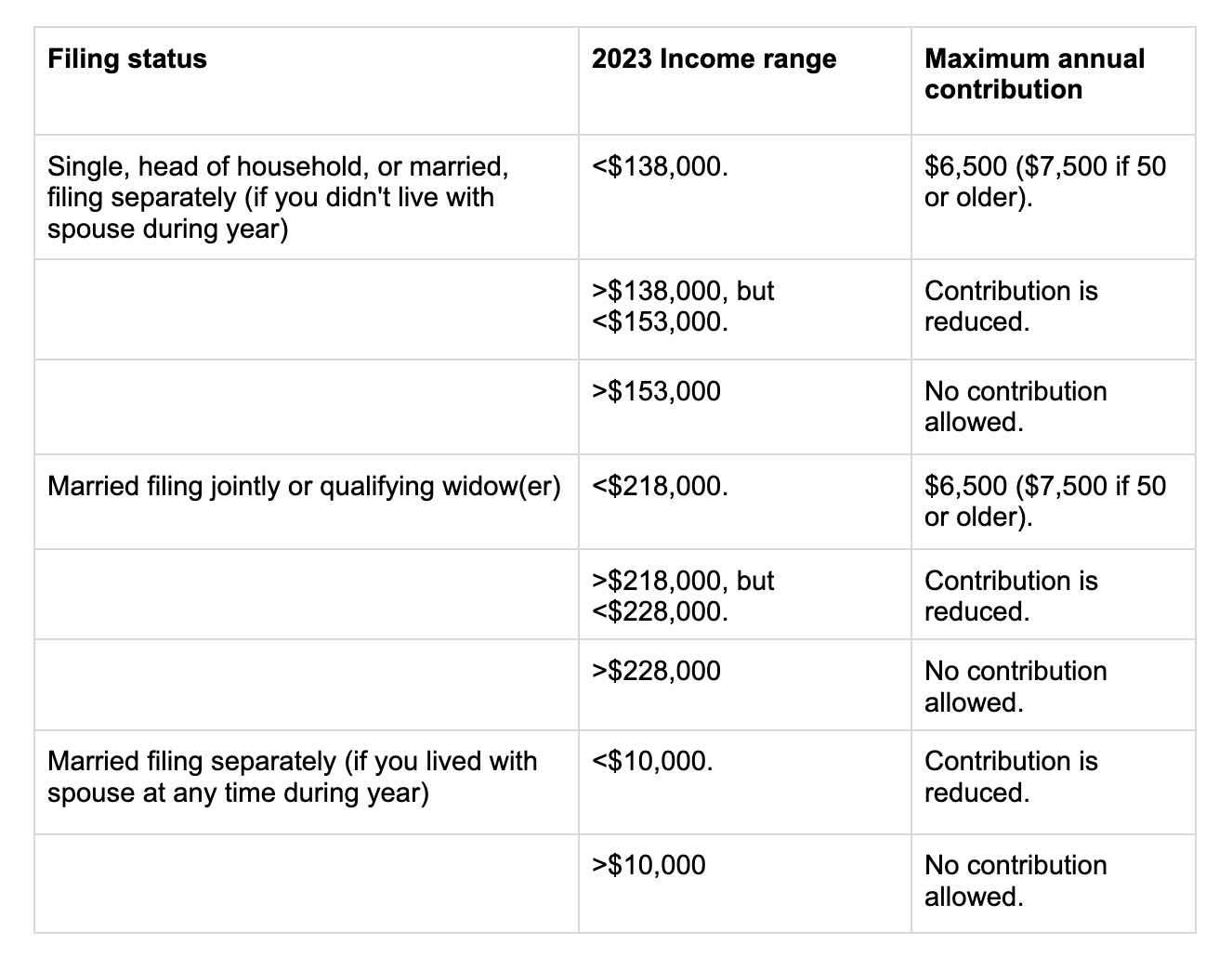

Roth Ira Contribution Limits In 2025 Meryl Suellen, Roth ira income and contribution limits for 2025. To be eligible to contribute the maximum amount in 2025, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year).

Backdoor Roth Ira Contribution Limits 2025 2025 Terra Rochelle, Know what to do if you contribute too much. Learn about the roth ira income limits for 2025, including updates and strategies for maximizing your contributions and retirement savings.

Roth Ira Limits 2025 Married Libby Othilia, $8,000 in individual contributions if you’re 50 or older. The irs's annual ira contribution limit covers contributions to all personal iras, including both traditional iras.

401k And Roth Ira Limits 2025 Sela Clemmie, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. Your personal roth ira contribution limit, or eligibility to.

Backdoor Roth Limits 2025 Flora Jewelle, $8,000 in individual contributions if you’re 50 or older. The maximum amount you can contribute to a roth ira in 2025 is $6,500, or $7,500 if you’re age 50, or older.

Use nerdwallet’s free roth ira calculator to estimate your balance at retirement and calculate how much you are eligible to contribute to a roth ira.